Written by John McFarland of the Oil and Gas Lawyer Blog.

So you have received a division order, and it says that ABC Oil Company will pay you for a .015625 royalty interest in the Barn Burner Unit #1 Well. How do you know whether the .015625 interest is correct?

I’ve written previously about the purpose and legal effect of division orders, and you can read that post here. The purpose of a division order is to protect the company paying the royalty (“payor”) from double liability. If you sign a division order and it turns out that you should have been paid a larger interest than shown on the division order, the company is protected as long as it paid according to the division order. If you sign a division order and it turns out that your interest is less than the interest shown on the division order, you are legally obligated to pay back the money that you weren’t entitled to. A payor is legally entitled to require that you sign a division order correctly setting forth your interest as a condition to payment.

To understand division orders, it is helpful to understand how exploration companies handle royalty payments. When a company decides it wants to drill a well in a particular area, it first hires landmen who investigate the mineral title to the tracts in the area where the well will be drilled and identify the mineral owners of those tracts. The company or its landmen then contact those mineral owners and negotiate oil and gas leases covering their interests. Depending on the complexity of the mineral title, there may be dozens or even hundreds of mineral owners from whom oil and gas leases must be obtained. The company may want to acquire leases in a large area around its proposed drillsite, in order to lock up the minerals in that general area so that additional wells can be drilled if the exploratory well is successful.

After the company has acquired the oil and gas leases in the area it wants to exploit, it picks its initial drillsite and then engages an oil and gas attorney to examine the title to the drillsite tract. The attorney reviews all of the documents gathered by the landmen involving the mineral title to the drillsite tract and then gives an opinion, called a drilling title opinion, to the company. The purpose of the drilling title opinion is to assure that the company owns oil and gas leases covering 100% of the mineral estate in the drillsite tract. If the drillsite consists of a pooled unit encompassing two or more smaller tracts, the drilling title opinion may cover all of the tracts in the proposed pooled unit. Where the well to be drilled is a horizontal well, the drilling title opinion should cover at least all of the tracts that will be penetrated by the well bore. If the attorney discovers an unleased interest or finds defects in the mineral title that raise questions about the mineral ownership, the company will engage a landman to “cure” these title defects prior to the drilling of the well.

Once the drilling title opinion is complete and shows that the company has the drillsite 100% leased, the company drills its well. If the well is successful and placed into production, then the company engages an attorney (who may or may not be the same attorney as the one who did the drilling title opinion) to prepare a division order title opinion. The purpose of this second opinion is to tell the company how to pay the royalty owners, based on the record title ownership of the minerals and the oil and gas leases covering the well or pooled unit. The division order title opinion will list each owner of an interest in production and that owner’s decimal interest in production, all of which must add up to 100%. Again, if there are issues regarding the correct ownership of any person, the opinion will discuss those issues and what needs to be done to “cure” the problem. Those issues are listed as “requirements” in the opinion. Where there are requirements, those owners affected by the requirements will not be paid until the requirements are cured. Remember that a title opinion is just that — an opinion. It is prepared by attorneys skilled in examining titles, but it may be wrong. First, it is based only on the documents provided to the attorney for review. The attorney may not have seen documents that affect the title, or the attorney may have missed provisions in the documents that affect the title. Second, it often involves interpreting documents in the chain of title that could be subject to more than one interpretation.

Based on the division order title opinion, the company then prepares a division order for each owner entitled to payment on production from the well and sends it to the owner. The company personnel who deal with division orders are called division order analysts. When you call a company asking about your division order, you are usually speaking to a division order analyst. Often, the royalty owner’s receipt of a division order is the first indication to the royalty owner that a well has been completed and is producing. Depending on the complexity of the title, there may be a significant time between the completion of the well and the issuance of division orders – sometimes several months.

So, back to our hypothetical. You have received a division order, and it says that ABC Oil Company will pay you for a .015625 royalty interest in the Barn Burner Unit #1 Well. How do you know whether the .015625 interest is correct?

Your decimal interest is calculated based on your royalty interest in the tract or unit on which the well is drilled. If your interest is a mineral interest, then it will be subject to an oil and gas lease, and that lease will reserve a royalty on production. So if you own a 1/16 mineral interest in the lands comprising the Barn Burner Unit, and if your mineral interest is subject to a lease reserving a 1/4th royalty, then your interest in production from the well is 1/16 of 1/4, or .015625.

Or, your interest could be a fee royalty interest – sometimes called a non-participating royalty interest — in production, entitling you to a share of the royalty but without the right to sign leases. There are two kinds of fee royalty interests – those expressed as a fractional royalty, and those expressed as a fraction of the royalty. So in our hypothetical, you may own a non-participating royalty interest of 1/16 of 1/4 of production (a fractional royalty) from the lands within the Barn Burner unit. Or, you might own a non-participating royalty equal to 1/16 of the royalty reserved in any lease of the lands in the unit (a fraction of the royalty). If you own 1/16 of the royalty, then you have to know what royalty was reserved by the leases from which your royalty is paid in order to verify your decimal interest in production. If the lease or leases covering the Barn Burner Unit reserve a 1/4 royalty and you own 1/16 of the royalty reserved in those leases, then your royalty is 1/16 of 1/4, or .015625.

So the first key to verifying the interest on the division order is to know what interest you own in the property.

The division order you received says your interest is in the Barn Burner Unit #1 well – the name implies that the well is on a pooled unit. If so, your royalty interest calculation will be affected by the fact that the operator created a pooled unit. Pooling is the combining of multiple tracts to create a large enough tract or unit to drill and produce the well. Most leases authorize the lessee to create pooled units. Pooled units are formed by filing a declaration of pooled unit in the deed records of the county that describes the leases and lands being pooled. The lease pooling provisions generally provide that production from a well on a pooled unit will be allocated among the tracts in the unit based on the number of acres in each tract compared to the total acres in the pooled unit. To illustrate, let’s suppose that you own a 1/4 mineral interest in 40 acres, and you leased your interest to ABC Oil Company and reserved a 1/4 royalty. Your lease authorizes ABC Oil Company to put your interest in a pooled unit. ABC forms a pooled unit of 160 acres and includes your 40-acre tract in the unit. Under the pooling clause in your lease, 40/160 of the production from a well on the unit will be allocated to your 40-acre tract – the size of your tract divided by the number of acres in the unit. This fraction is called the “tract factor.” Each tract in the pooled unit has its own tract factor, and all tract factors in the unit add up to one. So your interest in production from the Barn Burner Unit is 1/4 (your mineral interest in the 40 acres) times 1/4 (the royalty reserved in your lease) times 40/160 (the unit tract factor), or .015625. To verify your decimal interest in the unit, you need to know your royalty interest in the tract, the number of acres of your tract included in the pooled unit, and the size of the pooled unit. And you need to verify that the company had authority under your oil and gas lease to form the pooled unit.

Verifying your division order interest (DOI), then, is a matter of gathering information. You may already know some of the information you need. Other information you may need to get from the operator of the well. Some operators are very helpful and willing to provide you the information you need to verify your interest — or at least to give you the formula used to calculate your interest: mineral interest times royalty times tract factor. Other companies are less helpful. Sometimes you have to call a royalty help line and listen to music while on hold, or leave a message. Often the cover letter sending the division order provides a name and number you can call. Be persistent. You’re entitled to the information you need to be sure you’ll be paid correctly. Signing a division order that has the wrong decimal has serious legal consequences.

In the last session of the Texas Legislature, Texas Land & Mineral Owners’ Association sponsored a bill to require companies to disclose the formula used to calculate a royalty owner’s division order decimal, if requested. The bill was opposed by the exploration industry and did not get a vote. I expect the bill will be introduced again. The bill and TLMA deserve the support of mineral and royalty owners. If you have not joined TLMA, go to www.tlma.org and do so.

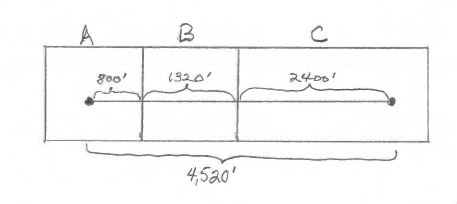

Lastly, a word about allocation wells. I’ve written about them before. Division orders for allocation wells are different from other types of division orders. An allocation well is the term used for a horizontal well that is drilled across two or more separate tracts that are not pooled. Suppose that ABC Oil Company drilled the Barn Burner 1H well across three tracts. The first tract is the tract where you own a 1/4 mineral interest that you leased to ABC, reserving 1/4 royalty. The second tract crossed by the well contains 40 acres, and the third tract contains 80 acres. The situation looks like this:

ABC does not form a pooled unit combining the three tracts. Instead, it proposes to allocate production from the well among the three tracts based on the percentage of the productive lateral of the well located on each tract. Tract A – the tract in which you own an interest – has 800 feet of the well lateral, so it gets allocated 800/4520 = 17.7% of the well’s production. Tract B gets 1320/4520, or 29.2%, and Tract C gets 2400/4520, or 53.1%. So the division order ABC sends you calculates your royalty interest as 1/4 X 1/4 X 800/4520 = .0110619. This division order is different from the division orders I discussed for pooled units because a division order for an allocation well is not based on any agreement as to how production from the well will be allocated among the tracts. It is in effect an offer by ABC to you to make an agreement with you on what share of the well you should get paid on. You can accept that offer by signing and returning the division order. If you disagree with how ABC proposes to allocate production, ABC will politely refuse to pay you, since you have refused to sign and return a division order. This is one of may problems with allocation wells that have yet to be worked out by the legislature and the courts. If you receive a division order that covers an allocation well, you should seek legal counsel before signing.